Wow Thanksgiving is almost here!! Its amazing how fast time can go 2012 is almost over!! How close are you to hitting your goals you had set for this year, or this quarter or just this week even! I hope your getting there and if not, lets reset and change something and do it again.

Hopefully you have gone though some of the books and principles I listed in part one of this article. What I wanted to cover today is something very basic but so vitally important to you financial success whether your making $30,000 a year or $300,000 per month! Its what every successful person and business does with regards to their finances. So if your in trouble financially this is the very first step you want to do.

You can get more in-depth detail from our Finance Pack http://www.the-life-business.com/Shopping/tabid/63/ProdID/1709/language/en-US/Default.aspx

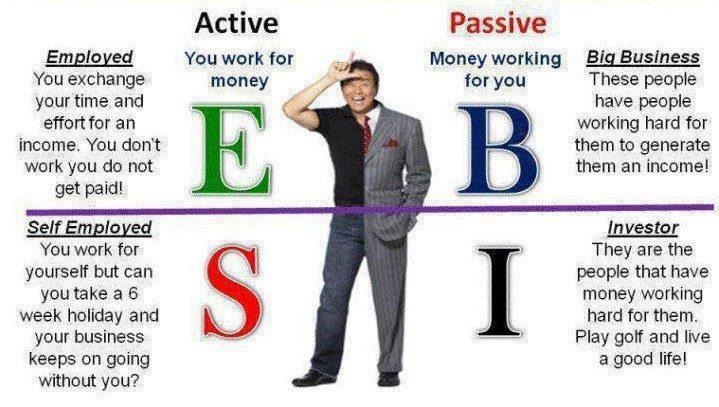

But the first thin you need to do is know exactly where your at with incoming and out going cash flow. Learning to write a balance sheet will help you with this as Robert Kiyosaki teaches this in his books too. But you need to know exactly where you are Net, not Gross. We need to work with exactly what you have coming in to your hands every week or two weeks or month.

Then we need to look at exactly what you spend every month. Now this one gets tricky and so people don’t self deceive them selves what you can do is use your smart phone and a app or a basic small note pad and pen to track everything you spend. if its more then 25 cents write it down or put it in your app. Do this for a month then look at it and see if what it says is as accurate as to what you were thinking it was.

This is the very first step to creating wealth in your life and its a non negotiable, if you don’t manage it then you never will, but if you do then the moon is the limit on what you can achieve.

Keep reading and learning, the Richest Man in Babylon is a great Book to start you on the right track of financial principles, its about 85 pages and the stories are more relevant now then they were 4000 years ago. So many people are selling them selves as slaves to interest and bad finances just as they did back then, except its a bit more comfy now, which is bad thing. There is no motivation to get out as there once was unless you have this realization that I want better for my life.

I hope you do! God bless and till next time when I write about what Thanksgiving is really all about and how it almost never was!

=)